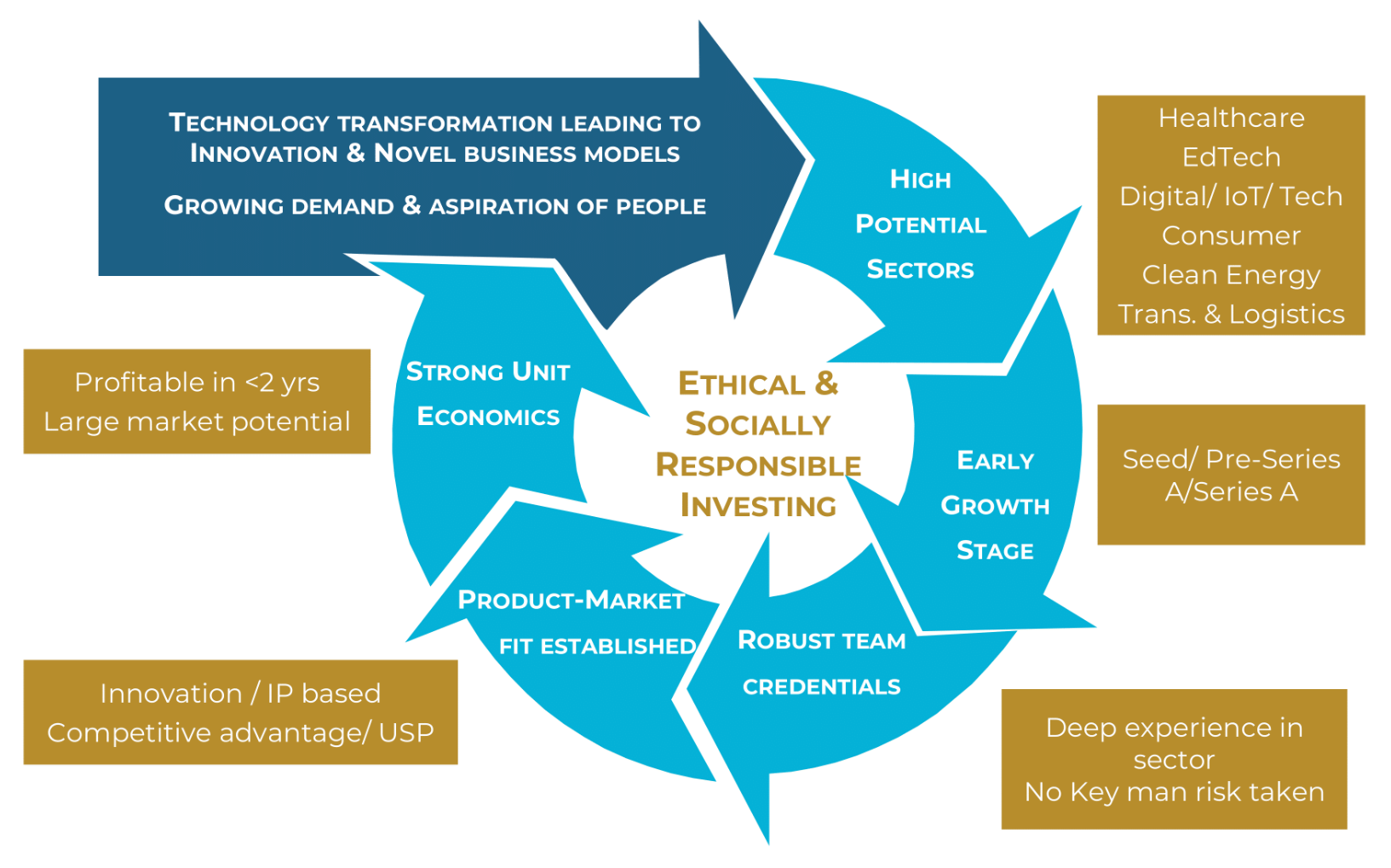

Invest in new age businesses which create useful innovation.

Target sectors and businesses that have a larger social impact while creating productive value in markets and societies.

Be fair to both investors and businesses through arrangements that are mutually beneficial.

No investment in predominantly fixed-interest debt based capital structures, which increases investment risk owing to the cyclical nature of the economy.

No investment in businesses involved in alcohol, gambling, or any other form of socially exploitative business.

Focus on long term sustainability and complete alignment of interest between investors and promoters.

Businesses required to concentrate on maximising enterprise value within the investment horizon and enable timely exit.

An investor’s capital is important, but not sacrosanct.

Fair and Equitable treatment of both parties.

During liquidation, an investor and entrepreneur should recover capital proportionately.

No unfair liquidation preference or “double dipping”.

Investors and businesses expected to share impacts of ups & downs in business.

Fair anti-dilution clauses.

Complete transparency of business operations and financials expected from entrepreneurs.

Investment funds to be utilised by the entrepreneurs, strictly in-line with the deal terms.

An investor shall not make guaranteed profits when the business does not.

As investment partners we take active part in facilitating business growth, strengthening governance and offering value-add via support from your networks.